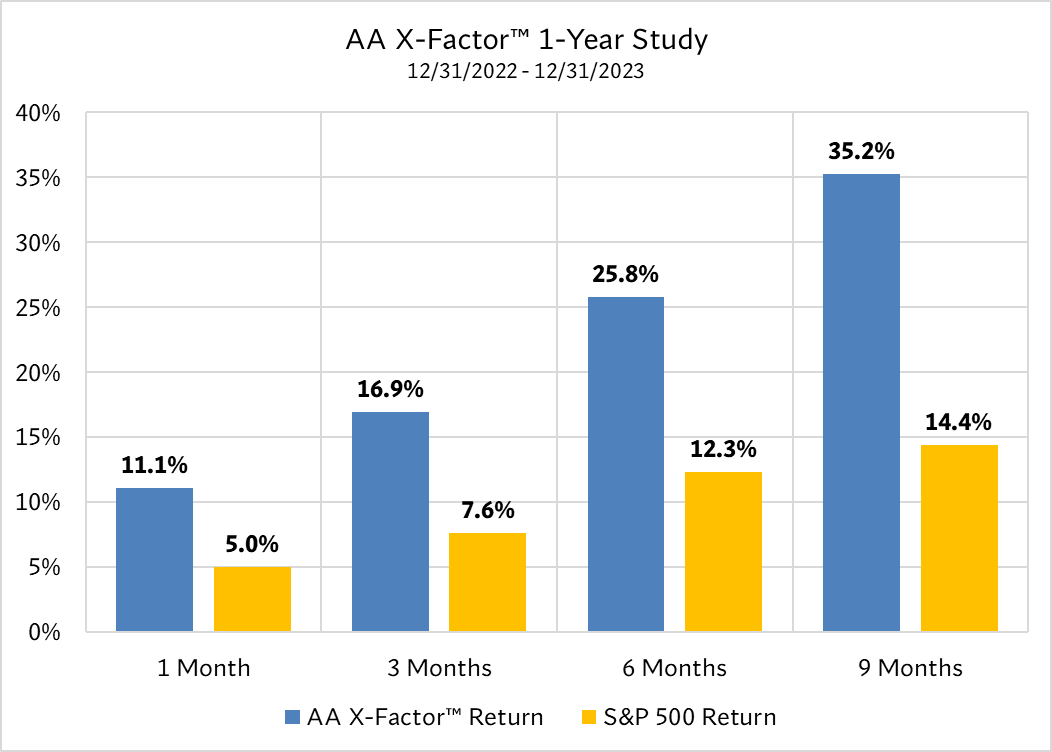

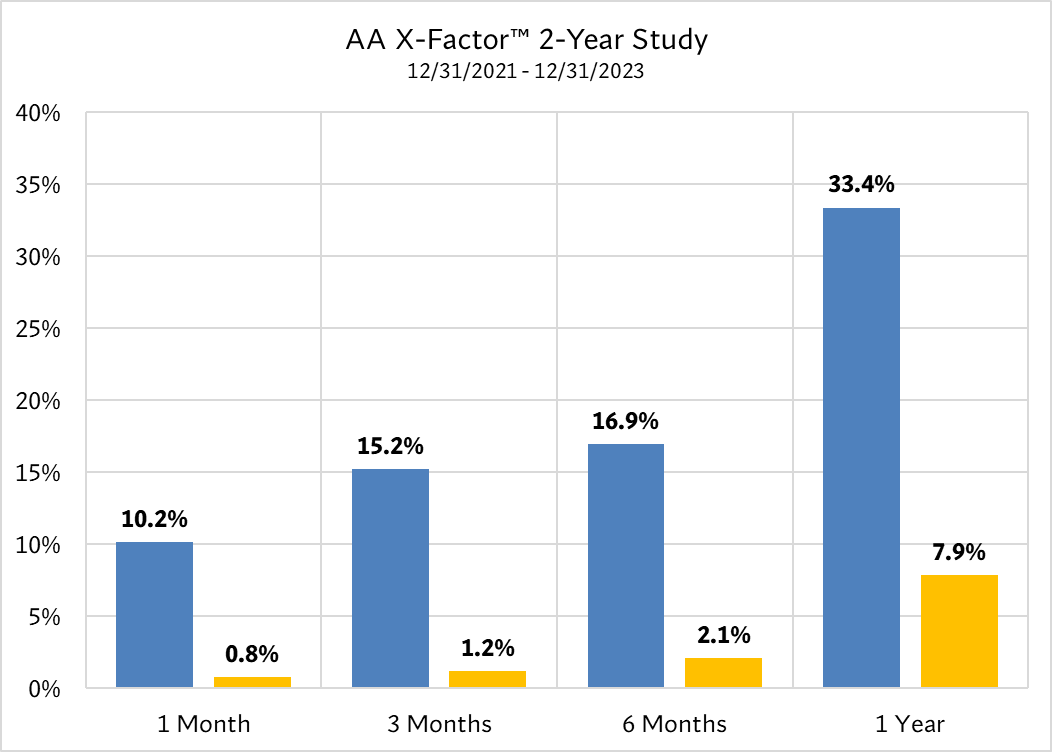

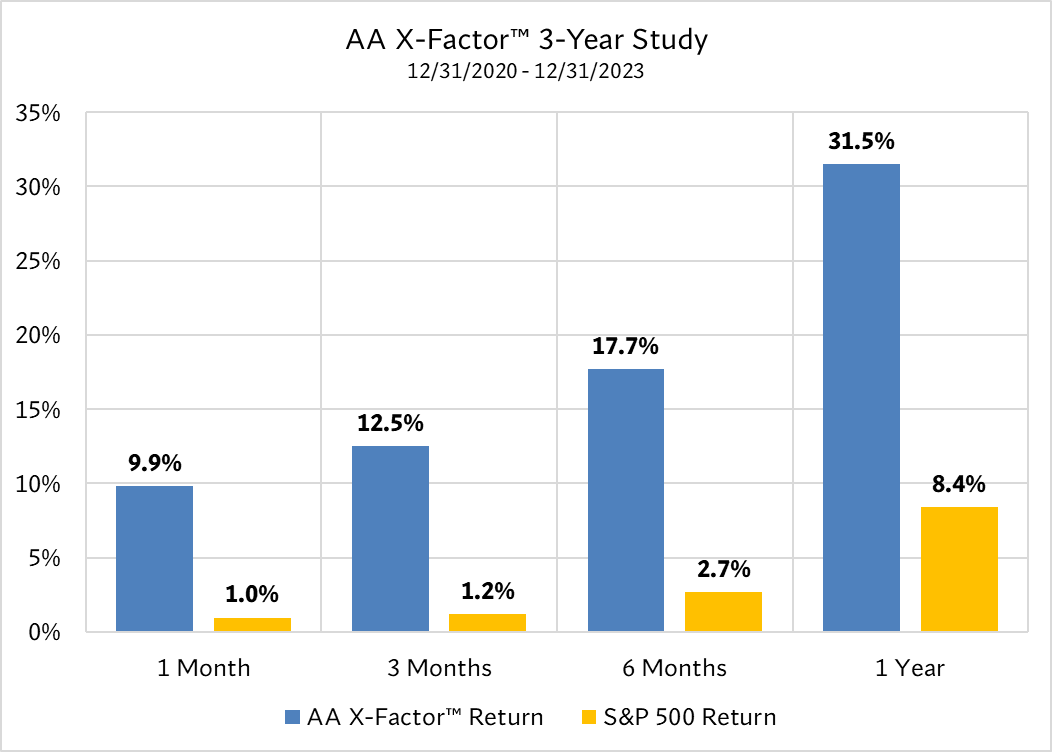

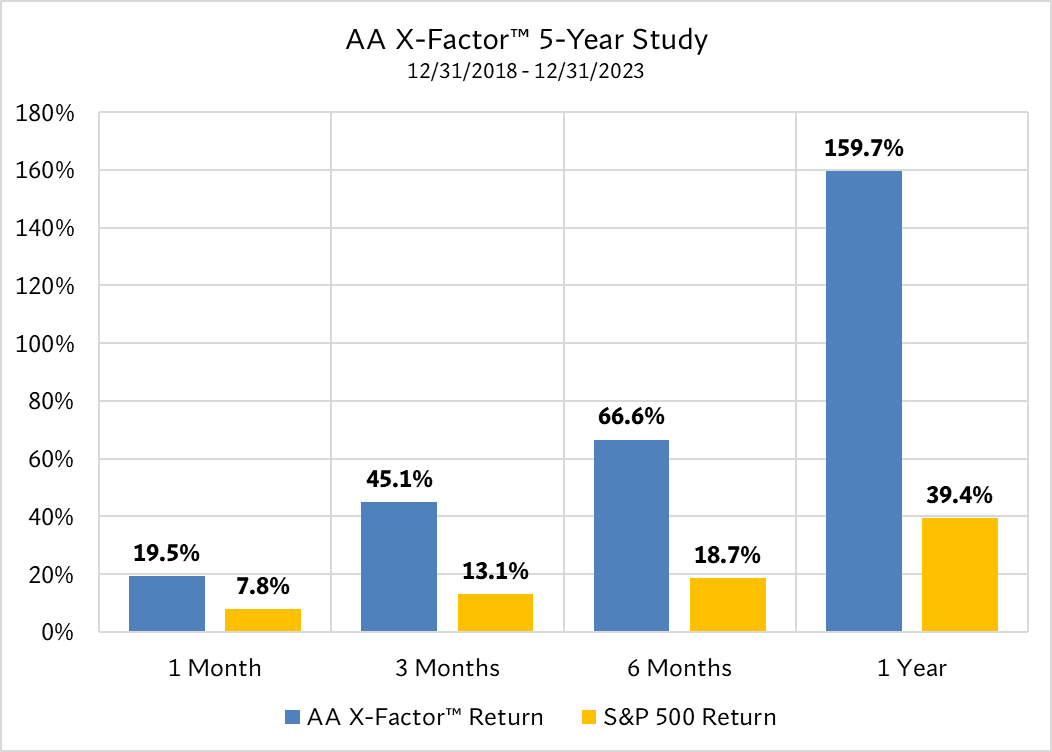

Equity Risk Sciences introduces Alpha Algorithmics X-Factor™

We seek joint ventures with hedge funds, family offices, insurance companies and brokerage firms.

Home (Apr 2022)2024-02-08T16:08:26-05:00